What it means: COVID-19 Deferral of Employee FICA Tax

Por um escritor misterioso

Descrição

On August 8, 2020, President Trump signed an Executive Order Deferring Employee FICA Taxes. We’ve put together a guide clarifying what the order means and who it applies to.

Unscrambling COVID-19 Legislation - Next Level Solutions

COVID-19, Hot Topics

Executive Order to Defer Social Security Taxes Unlikely to Affect Program Sustainability—But Social Security Reform Desperately Required, Payroll Tax Cut Possible

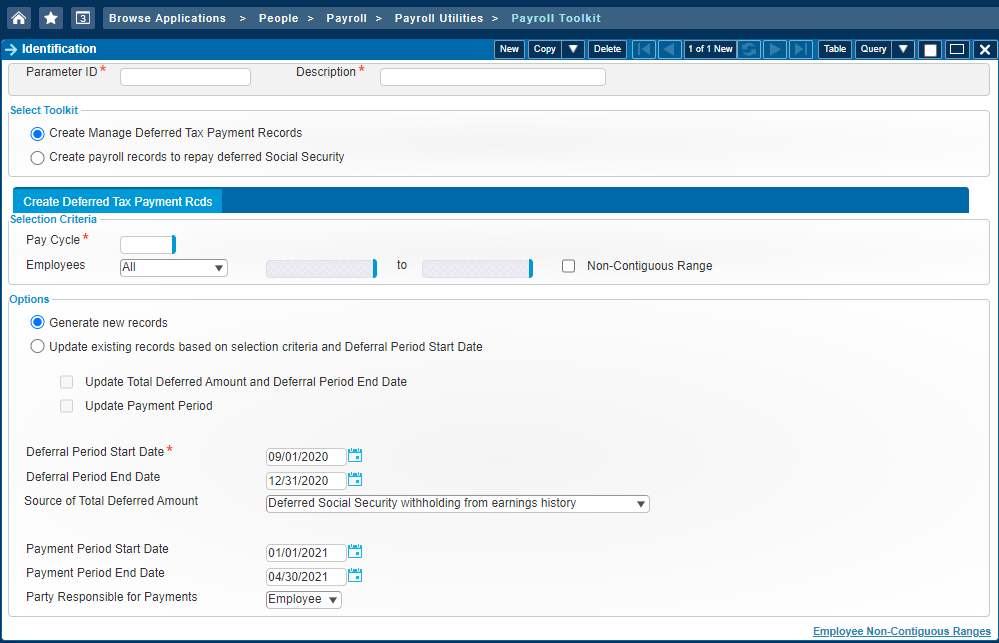

SS-R Deferment in M3

IRS releases final instructions for payroll tax form related to COVID-19 relief - Miller Kaplan

How Pausing the Payroll Tax Will Help Businesses Keep Workers Employed and Paychecks Flowing Amid the Coronavirus Pandemic

Self-employed Social Security Tax Deferral

COVID Updates

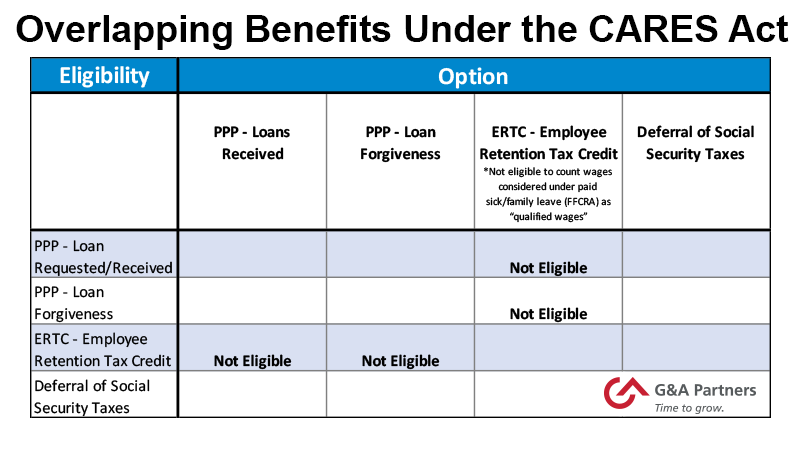

CARES Act: Implications for Employers - G&A Partners

IRS Updated Form 941 for COVID-19 Related Employment Tax Credits

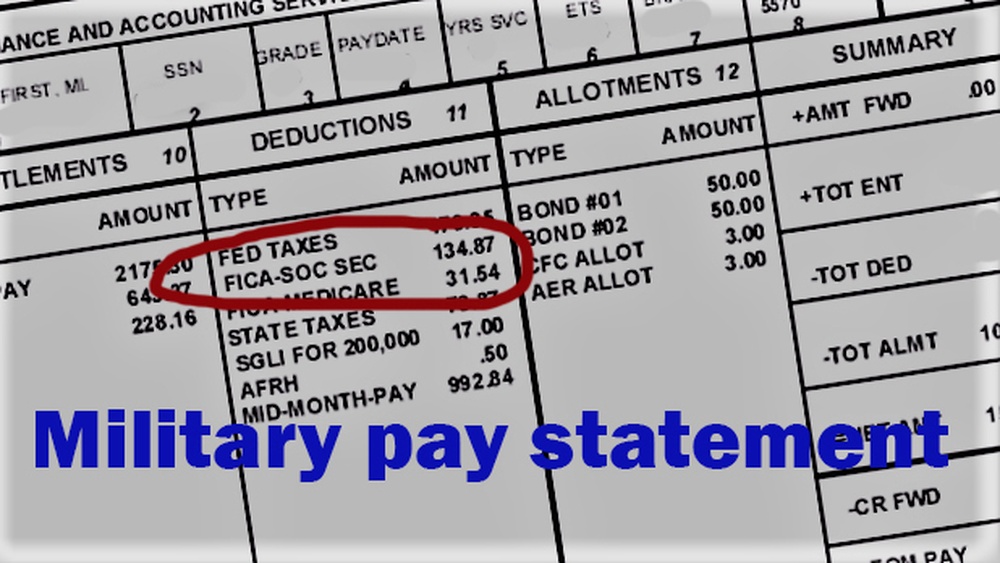

DVIDS - News - Social Security payroll tax deferral begins for DOD employees

37th Training Wing - Teammates, please see the below details regarding the OASDI Social Security Payroll Tax Withholding Deferral. The deferment is intended to provide temporary financial relief during the #COVID-19 pandemic.

President Defers Payroll Taxes: What Does It Mean?

Questions Remain After IRS Rolls Out Guidance On Payroll Tax Deferral