What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax

Por um escritor misterioso

Descrição

Your company always uses to deduct a certain amount from your each pay period. Payroll taxes are the means through which the government receives this money.

FICA stands for Federal Insurance Contributions Act. FICA is a federal payroll tax which is needed to be paid

FICA stands for Federal Insurance Contributions Act. FICA is a federal payroll tax which is needed to be paid

How To Calculate Federal Income Taxes - Social Security & Medicare Included

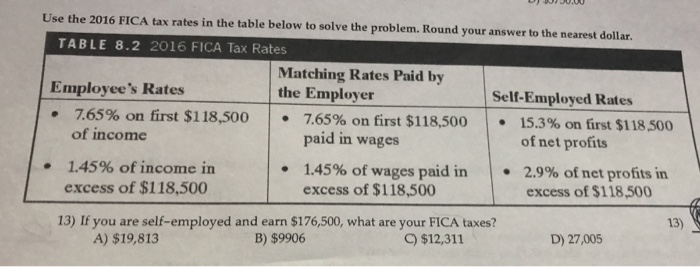

Solved D JU.00 Use the 2016 FICA tax rates in the table

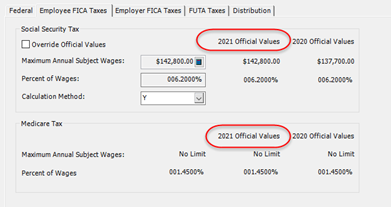

How to Proof FIT Tax Calculation

How to Calculate Taxes on Tips: A Step-by-Step Guide for Servers

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

Tax Strategies for Parents of Kids with Special Needs - The Autism Community in Action

How to Calculate Payroll Taxes in QuickBooks - Dancing Numbers

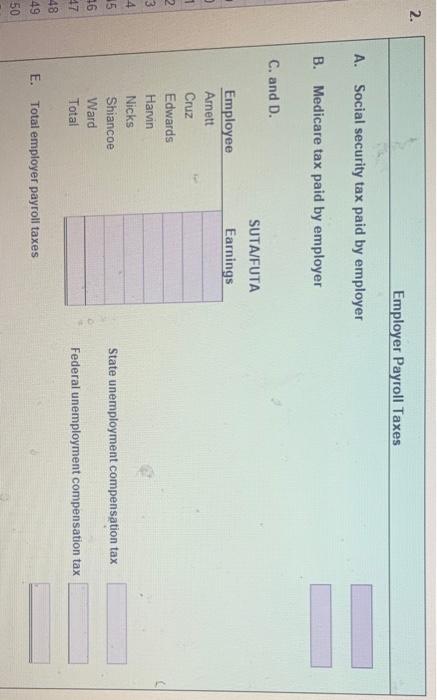

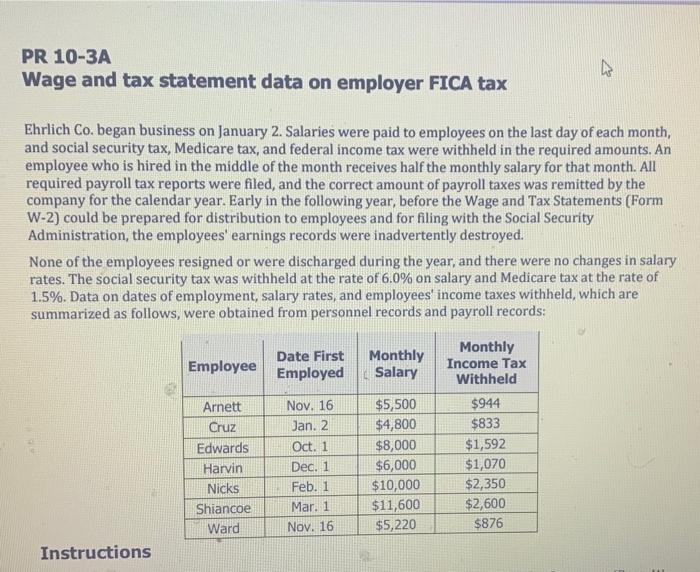

Solved PR 10-3A Wage and tax statement data on employer FICA

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

Learn About FICA Tax and How To Calculate It

SOLUTION: 56400017 - Studypool

Paying Taxes in Retirement - The New York Times

:max_bytes(150000):strip_icc()/GettyImages-473687780-2bab3391ebc34262a962f386104ed436.jpeg)

How To Calculate Social Security and Medicare Taxes

StubHub Taxes 2023: Write-offs, Taylor Swift Ticket Sales and More

Solved PR 10-3A Wage and tax statement data on employer FICA

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)