FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Por um escritor misterioso

Descrição

IRS Guideline: Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees What is FICA? FICA is the abbreviation of the Federal Insurance Contribution Act. The FICA tax is a United States federal payroll tax administered to both employees and employers to fund Medicare and Social Security. This means that when you…

Substantial Presence Test Calculator for F1 Visa

How does a student on an F1 OPT visa go about claiming a FICA

Students on an F1 Visa Don't Have to Pay FICA Taxes —

1040nra Delaware City DE

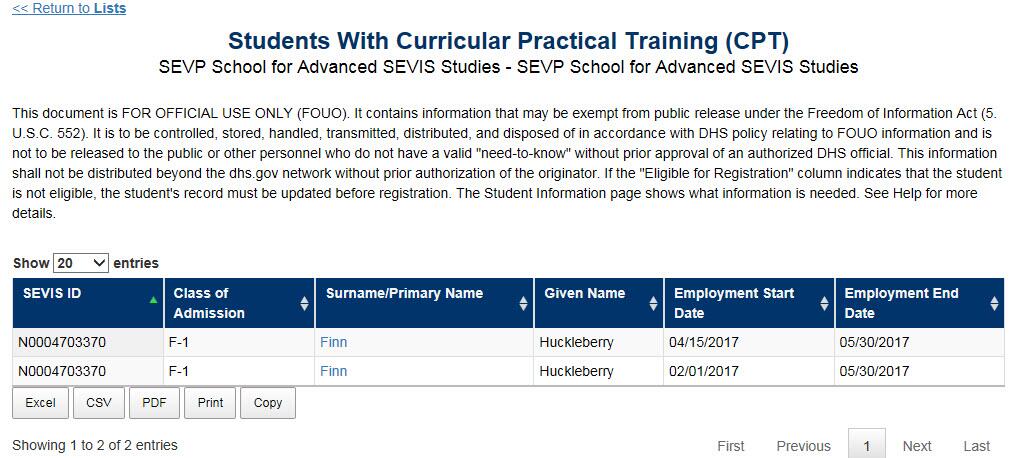

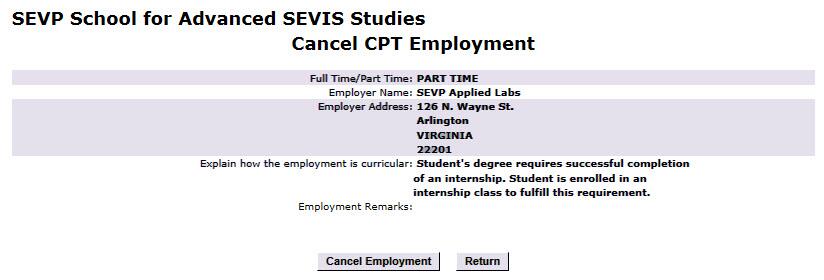

F-1 Curricular Practical Training (CPT)

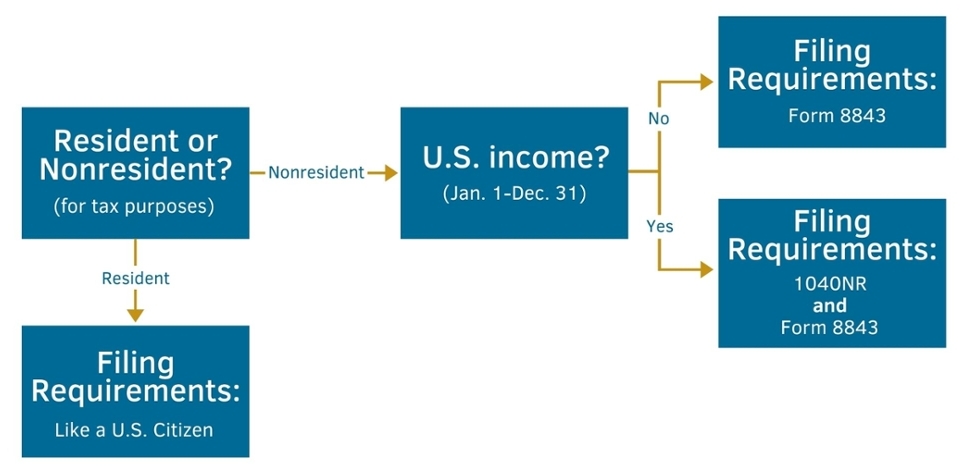

F-1 International Student Tax Return Filing - A Full Guide [2023]

Everything you need to know about OPT Taxes

F1 CPT Rules: ICE, SEVP, Federal Regulations References- 1 Year

OPT Student Taxes Explained

Taxes - International Student & Scholar Services - The University

US Taxes for International Students : Ultimate Guide

F-1 Curricular Practical Training (CPT)

Tax Resources

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)