Students on an F1 Visa Don't Have to Pay FICA Taxes —

Por um escritor misterioso

Descrição

In general, non-US citizens employed in the U.S. are required to pay FICA taxes. However, those with single intent, or non-immigrant status (or F1 visa holders) are exempt from FICA taxes.

F-1 International Student Tax Return Filing - A Full Guide [2023]

How To Handle Taxes With An F-1 Visa

Filing Taxes When You've Been Employed On Campus

US Taxes for International Students - International Services

Substantial Presence Test Calculator for F1 Visa

The Trump Administration Worked to Limit the Entry of Foreign Students. How Did It Impact Higher Education?, News

F1 Visa Students Stock Trading – Allowed? Invest: Buy, Sell, Taxes? [2023]

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

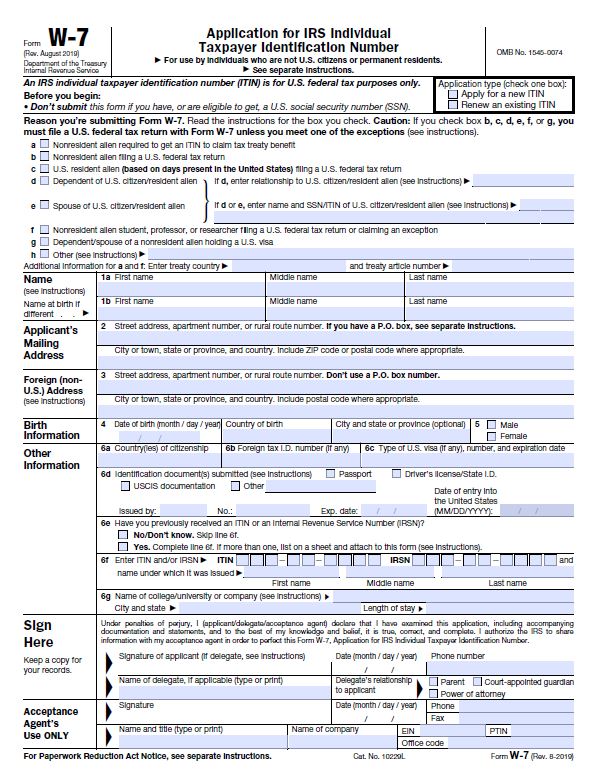

5 US Tax Documents Every International Student Should Know

Alien Registration Number - How to Find Your A-Number