The calculations used in the average cost method depend on whether the business is using a periodic inventory system of a perpetual inventory system. The cost of goods sold is crucial to you, investors, your business, and analysts. It is derived from the sales revenue to determine the gross margin on the income statement. Your business and other businesses can use the average cost inventory or the other two methods (FIFO and LIFO) to ascertain the cost of goods sold. If the inventory is purchased and sold on the same day, it is essential to first recalculate the average cost after accounting for the additions that day before valuing the units sold. Businesses that sell products to customers have to deal with inventory, which is either bought from a separate manufacturer or produced by the company itself.

Average Cost Method for Inventory Accounting

A change in your accounting method not only includes a change for cash to accrual but also the treatment of any material item. A material item is one that affects the time for proper reporting of the income or deduction. Incidentally, QuickBooks desktop software products (Pro, Premier and Mac) use ‘average costing’ versus QuickBooks Online, which uses ‘FIFO costing. Businesses can optimize inventory management costs by implementing just-in-time inventory practices, leveraging inventory management software, negotiating favorable supplier contracts, and streamlining warehouse processes. Common inventory valuation methods include FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and Weighted Average Cost Method, each with its own implications for financial reporting and tax obligations.

Everything You Need To Master Financial Modeling

The most common inventory valuation methods include FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and Weighted Average Cost Method. Conversely, when prices fall (deflationary times), FIFOending inventory account balances decrease and the income statementreflects higher cost of goods sold and lower profits than if goodswere costed at current inventory prices. The effect of inflationaryand deflationary cycles on LIFO inventory valuation the home office deduction are the exactopposite of their effects on FIFO inventory valuation. The average cost method finds varied applications across different industries, each with its own considerations. In sectors like manufacturing, where products are produced in large batches, this method provides a streamlined approach to inventory costing. It ensures that manufacturing entities can maintain consistent cost records without tracking individual component costs.

Using the Average cost inventory method (WAC) in a perpetual inventory

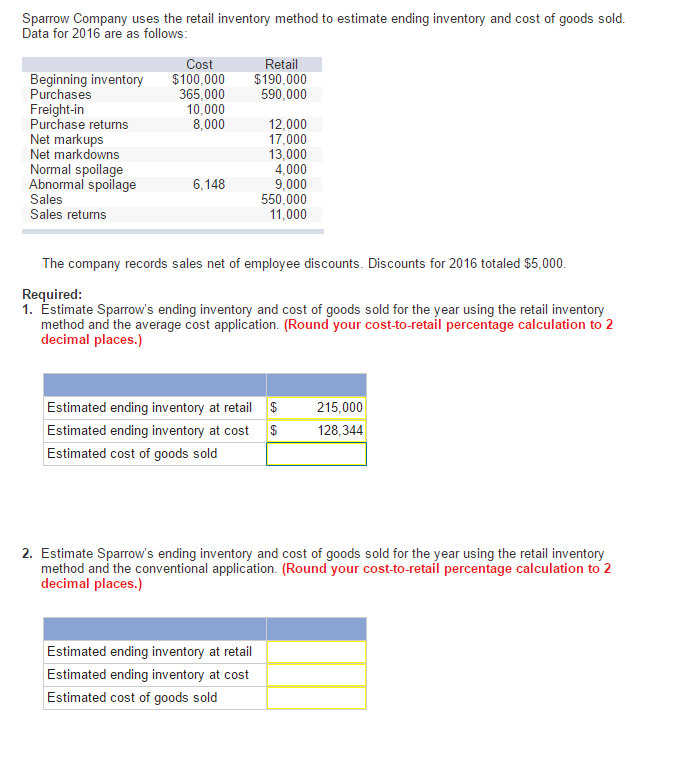

The simple average unit cost of 6.33 compares to the weighted average cost calculate earlier of 6.20. The method gives a reasonable estimate of the inventory value when the beginning inventory and purchases are of a similar level. Average Costing is used to track inventory costing via ‘average’ cost, or by averaging the costs of all the quantities that are in stock divided by the total cost of those purchases. The Average Costing Method takes the last purchase of on-hand stock, and any prior purchases, in order until all quantities are accounted for. Sometimes companies have a need to estimate inventory values.These estimates could be needed for interim reports, when physicalcounts are not taken.

Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. On 1 January, a shop has 10 units of a specific type of gaming device in inventory valued at $25 per unit. The first step in finding the ending inventory value is to calculate the units of ending inventory. Inventory costs comprise direct costs, such as raw materials and labor, and indirect costs, including storage, insurance, and administrative expenses. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

Consequently, the cost of goods sold reflects the cost of the most recent inventory purchases, while the ending inventory consists of older, lower-cost items. LIFO tends to result in lower reported profits during periods of rising prices because the cost of goods sold is based on higher, more recent costs. Then the ending inventorycan be calculated by subtracting cost of goods sold from the totalgoods available for sale. Likewise, the retail inventorymethod estimates the cost of goods sold, much like thegross profit method does, but uses the retail value of the portionsof inventory rather than the cost figures used in the gross profitmethod. When average costing is applied to inventory, the nature of the method used is commonly included in the footnotes that accompany the financial statements. These footnotes are not released when financial statements are only being issued internally, since the management team is already aware of the costing method being used.

- Ensure that the method of inventory costing that you choose remains the same throughout.

- His background is in e-commerce internet marketing and he has helped design the requirements for many features in Dynamic Inventory based on his expertise managing and marketing products online.

- This is presented in the firstpart of the results of operations for the period on the multi-stepincome statement.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. Small ups and downs don’t really matter since the deviation from the trend isn’t that significant.

It is useful in industries like manufacturing and retail, where inventory turnover is high and prices fluctuate. By smoothing out price variations, this method offers a stable view of inventory costs over time. The cost of goods sold, or COGS, includes both the costs of the inventory items and additional expenses, such as shipping costs, customs fees and packaging. Average costing assigns all inventory items a single cost price derived from the average cost of all those items.