BIR clarifies taxability of insurance companies - PDF Free Download

Por um escritor misterioso

Descrição

Volume 10 No. 8 BIR PRIORITIES * Exceed BIR revenue target of P 845 Billion for 2008 * Improve taxpayer satisfaction and compliance * Improve taxpayer and taxfiler base BIR clarifies taxability of insurance

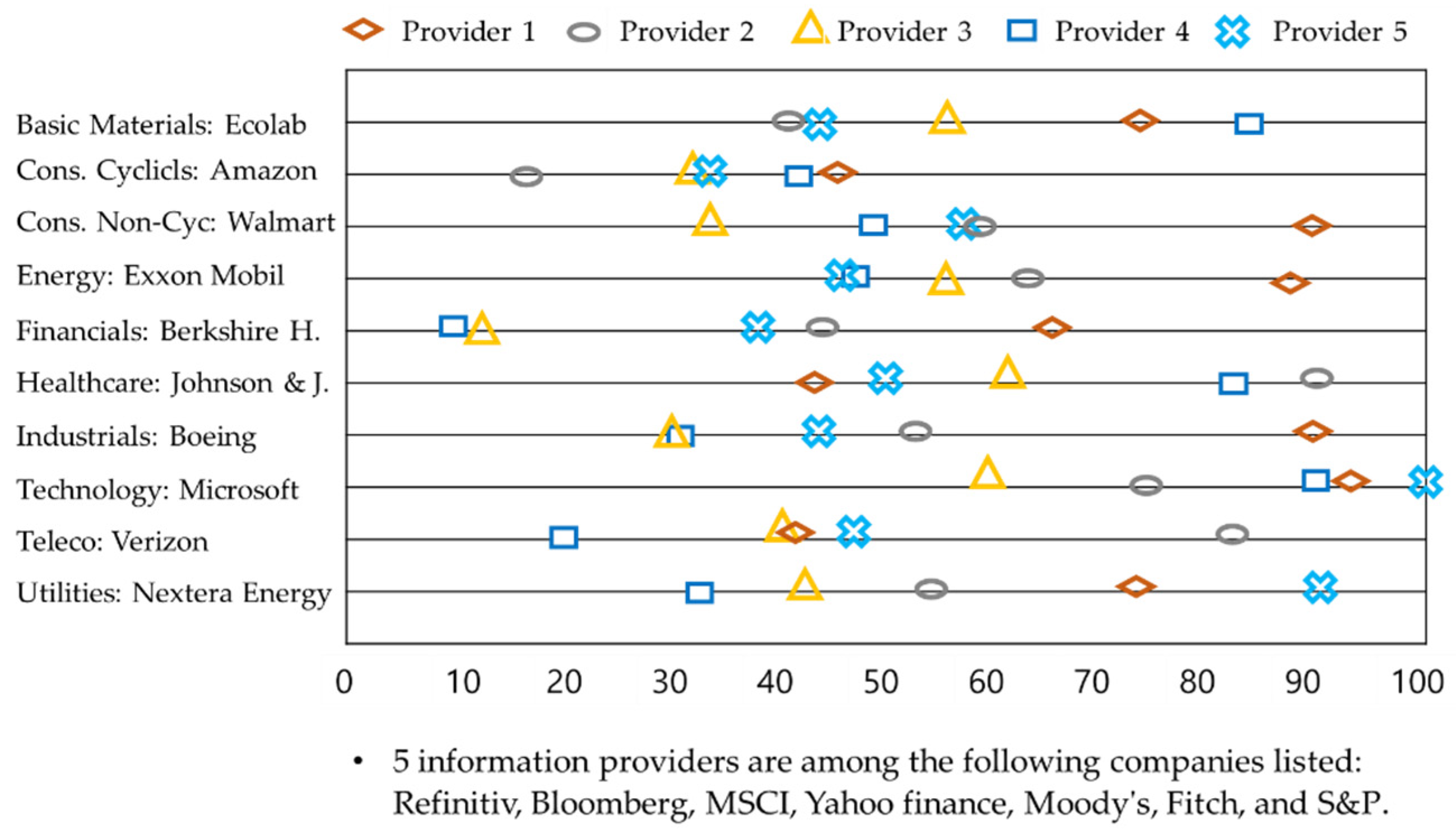

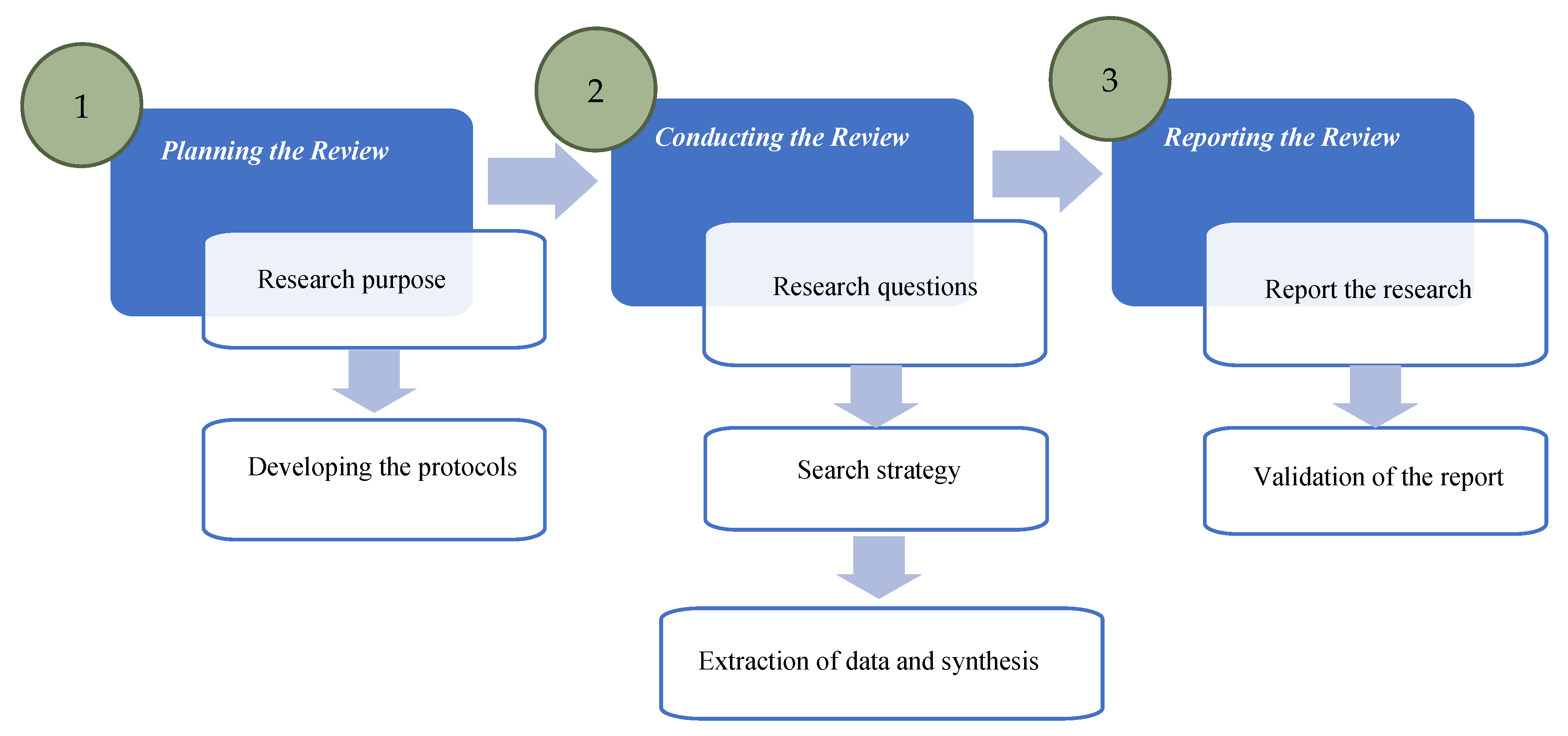

IJFS, Free Full-Text

57 BM Taxation, PDF, Life Insurance

Insurance - Wikipedia

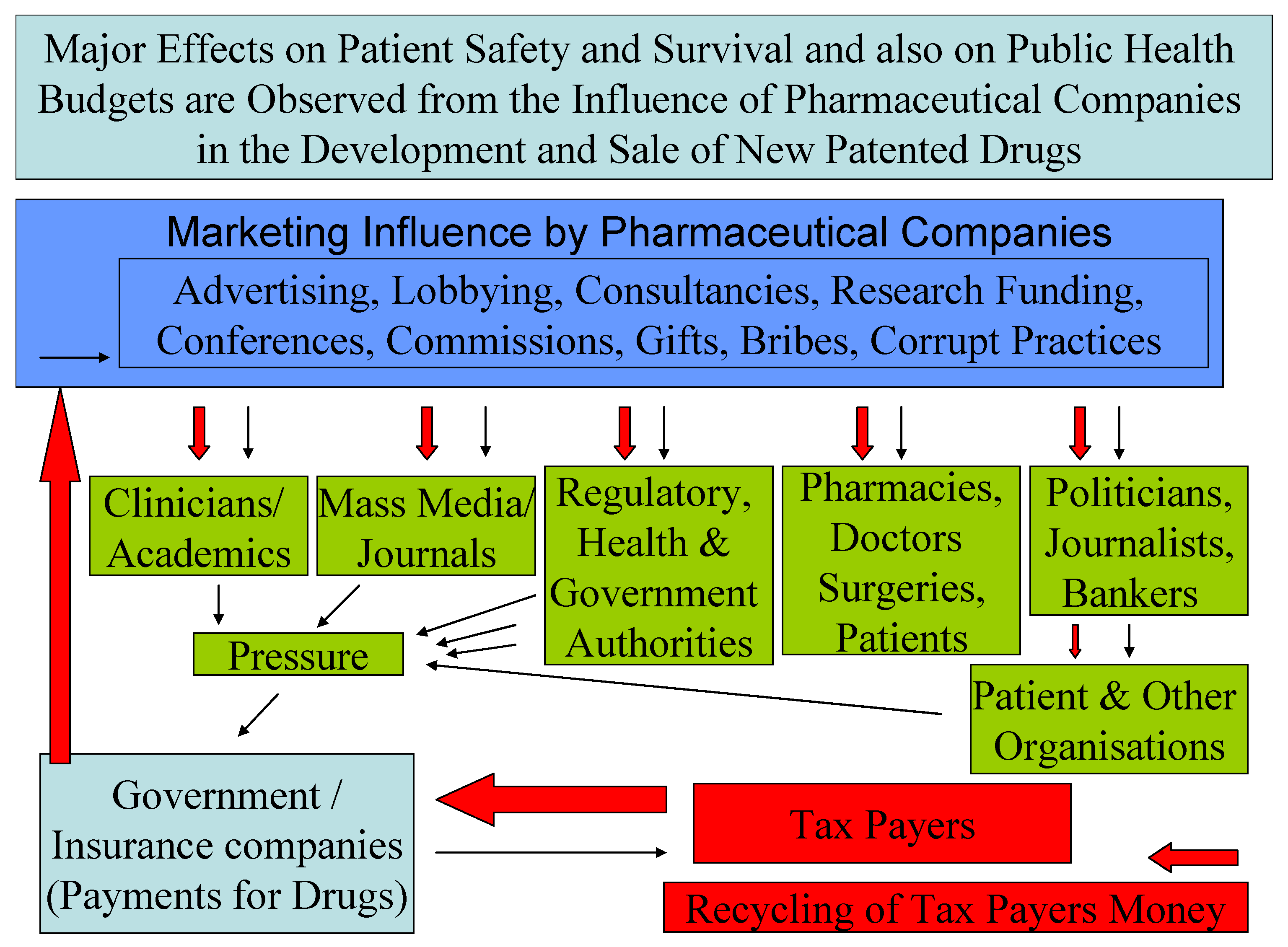

Medicines, Free Full-Text

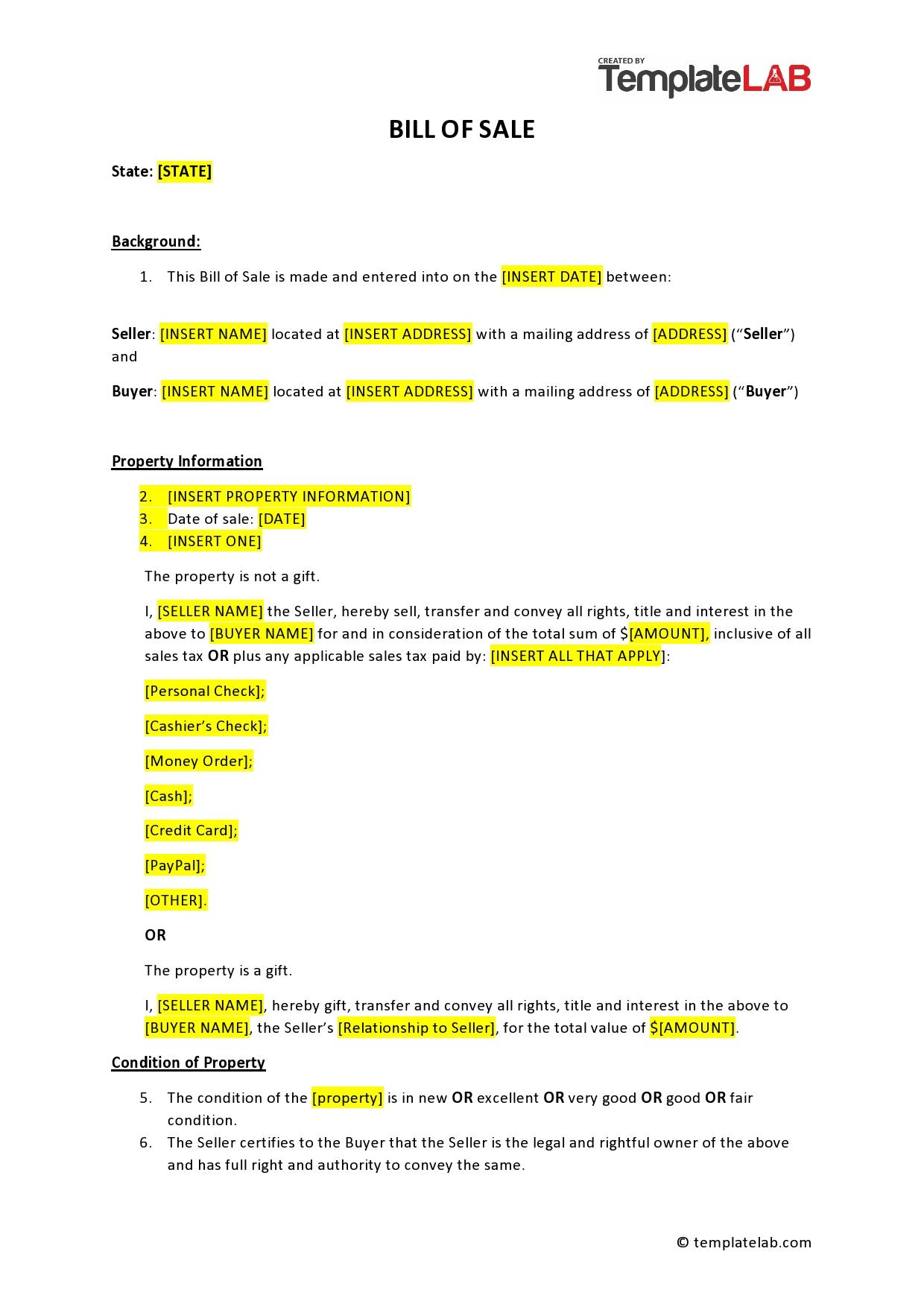

45+ Printable Bill of Sale Templates [Free] (Word, PDF)

TAXATION OF PROPERTY AND CASUALTY INSURANCE COMPANIES - PDF Free

PERSONAL FINANCIAL PLANNING — Modernist Financial

Opportunity zones: Tax reporting reminder

Clarifying VAT and EWT Rules On Security and Manpower Agencies

FIRE's Guide to Free Speech on Campus

Responding to the opioid crisis in North America and beyond

TAXATION OF PROPERTY AND CASUALTY INSURANCE COMPANIES - PDF Free

Podcast: Bank Notes - FEDERAL RESERVE BANK of NEW YORK

Applied Sciences, Free Full-Text

Property Sale Agreement - 13+ Examples, Format, Pdf