or Sale of $600 Now Prompt an IRS Form 1099-K

Por um escritor misterioso

Descrição

Starting in 2022, selling as little as $600 worth of stuff on a site like , or Facebook Marketplace, will prompt an IRS 1099-K.

Form 1099-K: Last-Minute IRS Changes & Tax Filing Requirements [Updated for 2024]

Form 1099 Rules for Employers in 2023

Tax News Archives - Optima Tax Relief

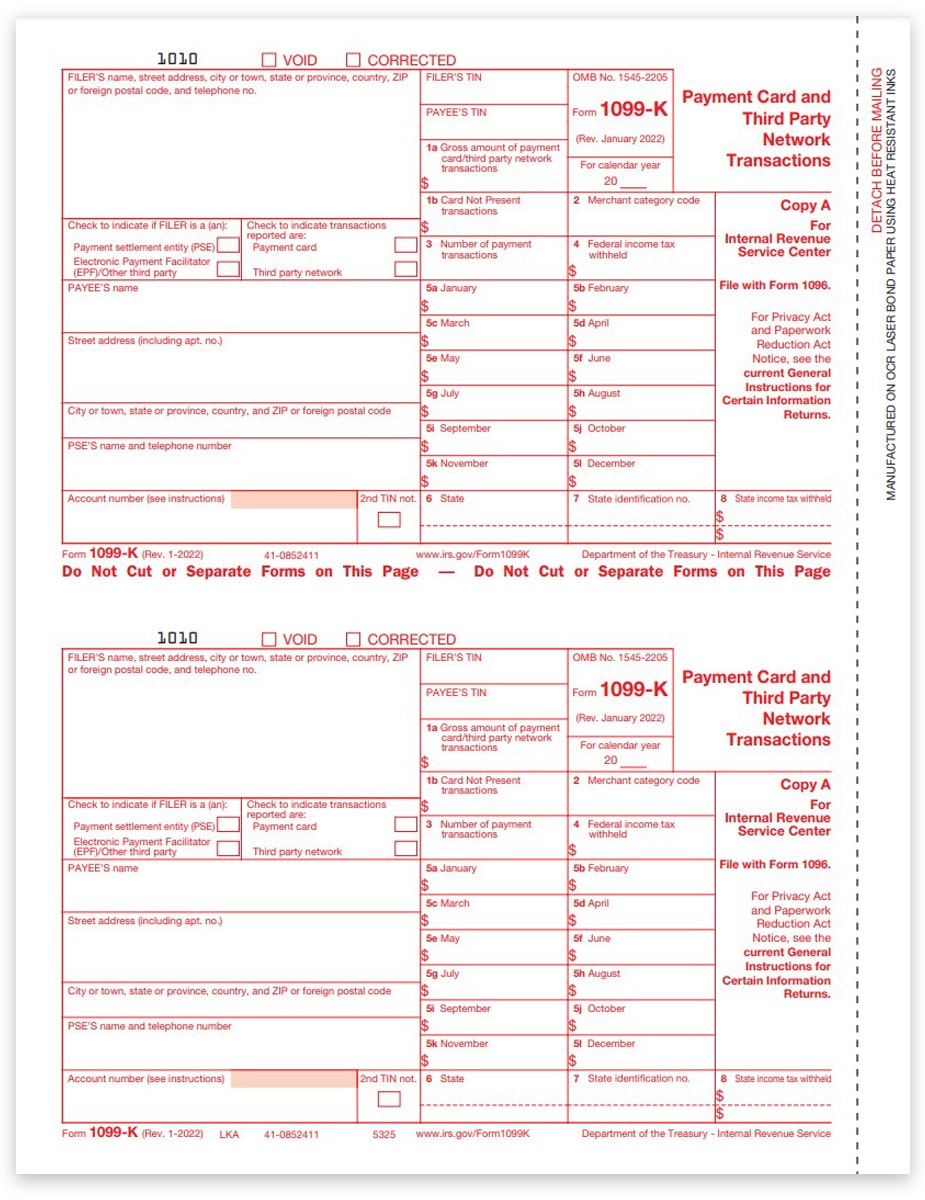

Official 1099K Tax Forms, Use 1099K Copy A forms to report payment cards and third-party network transactions to the IRS., Order as few as 25 forms

1099-K Form - Copy A Federal

Jobber Payments and 1099-K – Jobber Help Center

Sales Taxes Relative To $600 1099 IRS Reporting Th - The Community

Getting paid on Venmo or Cash App? This new tax rule might apply to you

New tax laws 2022: Getting paid on Venmo or Cash App? This new tax rule might apply to you - ABC7 New York

UPDATE: PLEASE READ. New TAX Requirements If You Sell >$600/Yr