MNCs sent tax notices over expat employees' allowances from foreign parent companies

Por um escritor misterioso

Descrição

The demands, ranging from ₹1 crore to ₹150 crore, cover the period between FY18 and FY22 for payments by foreign parent companies to expats working in Indian subsidiaries of MNCs

International HR Adviser Spring 2016 by International HR Adviser - Issuu

Tax Challenges for German Industry in the People's Republic of China by Bundesverband der Deutschen Industrie e.V. - Issuu

U.S. Expats Archives

News

What are the most popular European Union programs for foreign talent?

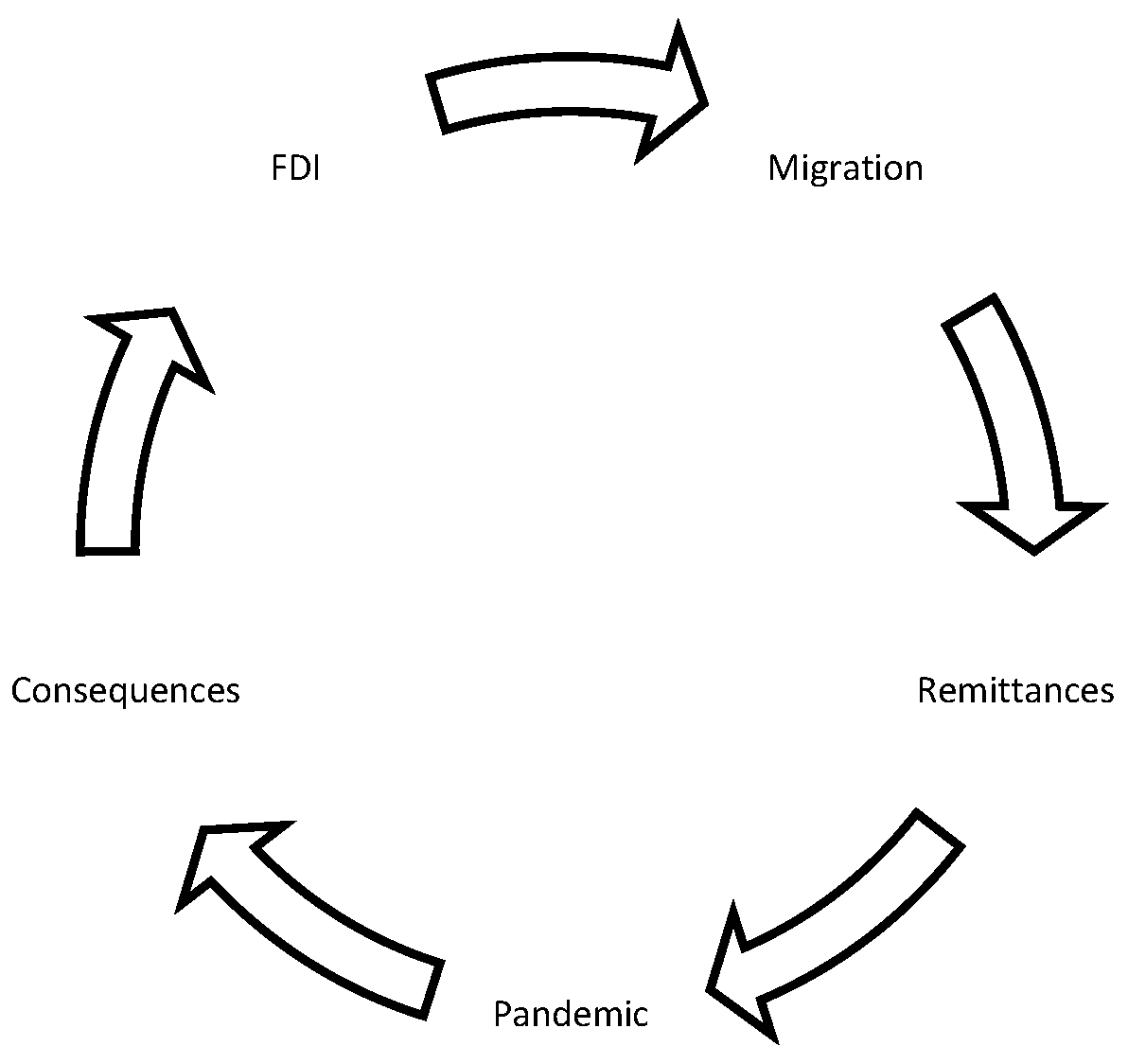

COVID, Free Full-Text

pwc-international-tax-news-august-2015

What Foreign Businesses Should Know Before Hiring Employees in Thailand, by 9cv9 HR and Career Blog, Top Rated by Readers, Nov, 2023

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DY66ULGMPJN3RKE7MFTAOF5374.jpg)

COVID-19's new expatriate employees

)

GST Tax Demand: India arms of 1,000 MNCs asked to pay GST on expat salaries, allowances

Who Is and Is Not an Expatriate

Expat salaries: Tax notices to MNCs

Multinational companies and the world economy: economic and technological impact

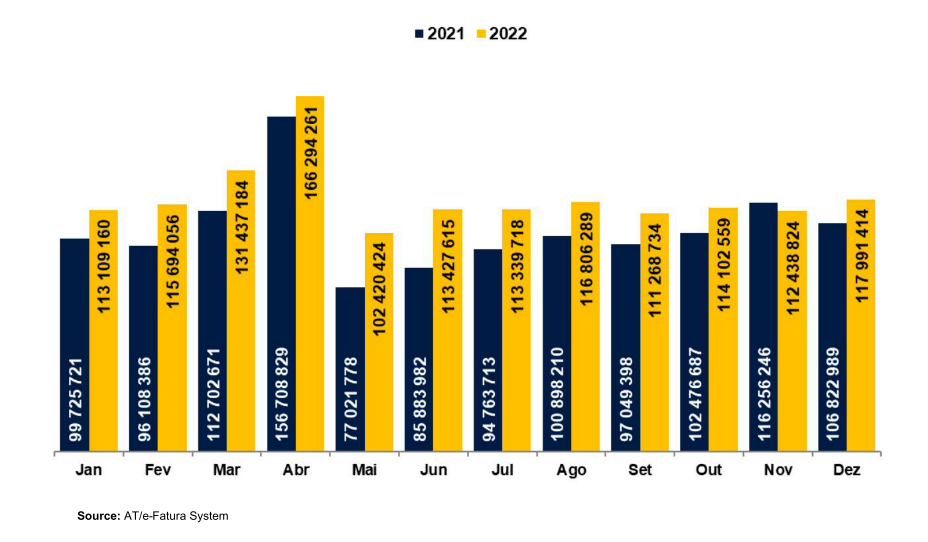

REPORT ON THE FIGHTING FRAUD AND EVASION TAX AND CUSTOMS 2022

Some of the ways multinational companies reduce their tax bills