What are FICA Taxes? Social Security & Medicare Taxes Explained

Por um escritor misterioso

Descrição

Federal taxes for Social Security and Medicare (FICA) are mandatory, so understanding them is important for all HR professionals. Here’s what you need to know.

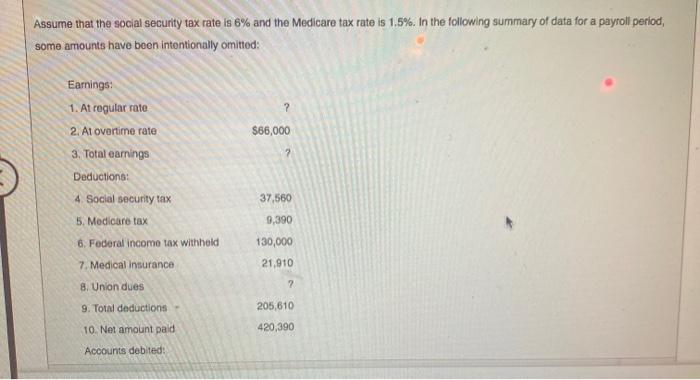

Solved Assume that the social security tax rate is 6% and

How Avoiding FICA Taxes Lowers Social Security Benefits

Federal Insurance Contributions Act - Wikipedia

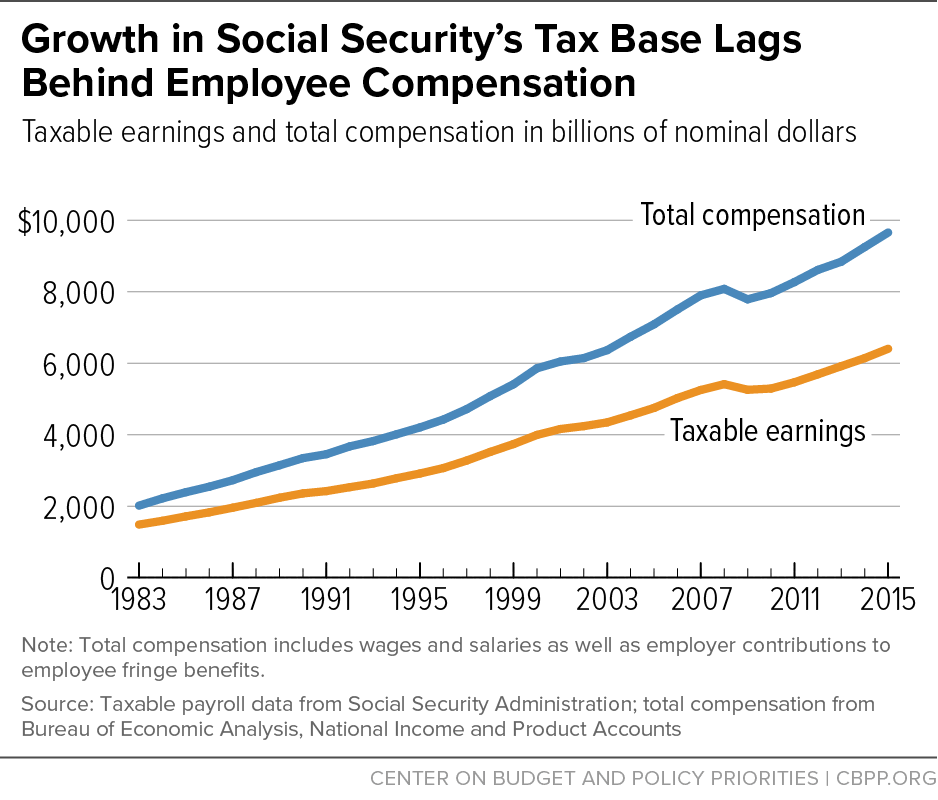

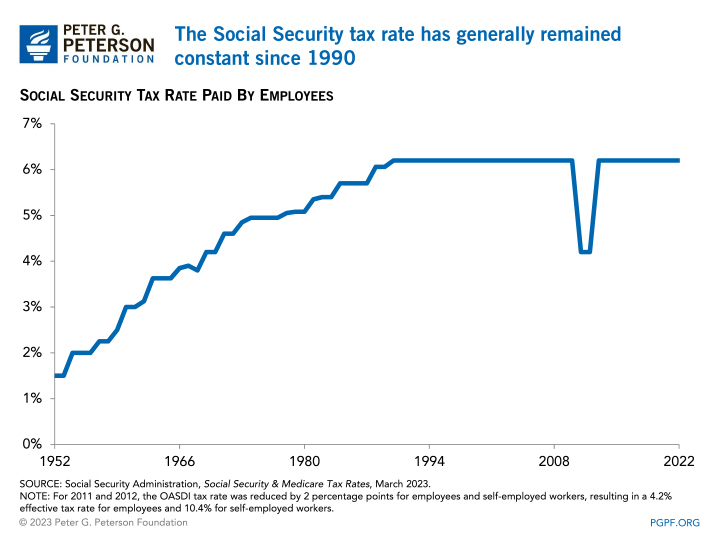

Increasing Payroll Taxes Would Strengthen Social Security

What is FICA Tax? - Optima Tax Relief

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

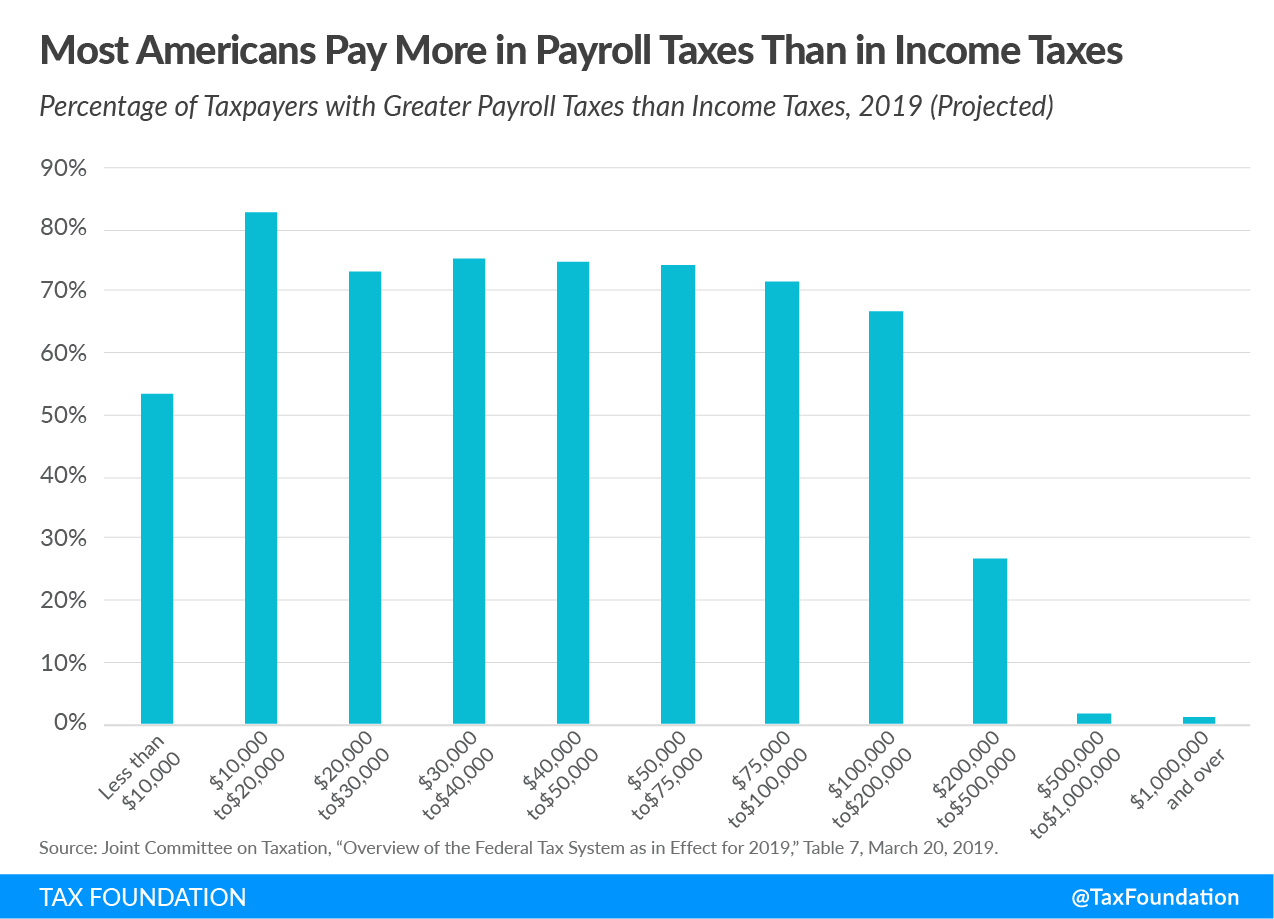

Payroll Tax Definition, What are Payroll Taxes?, TaxEDU

Payroll Taxes: What Are They and What Do They Fund?

Maximum Taxable Income Amount For Social Security Tax (FICA)

Income Taxes: What You Need to Know - The New York Times

What are the major federal payroll taxes, and how much money do

The Average American Pays This Much in Social Security Payroll Tax