Tax holidays and profit-repatriation rates for FDI firms: the case of the Czech Republic

Por um escritor misterioso

Descrição

PDF) A review of Tax Incentives and its impact on Foreign Direct

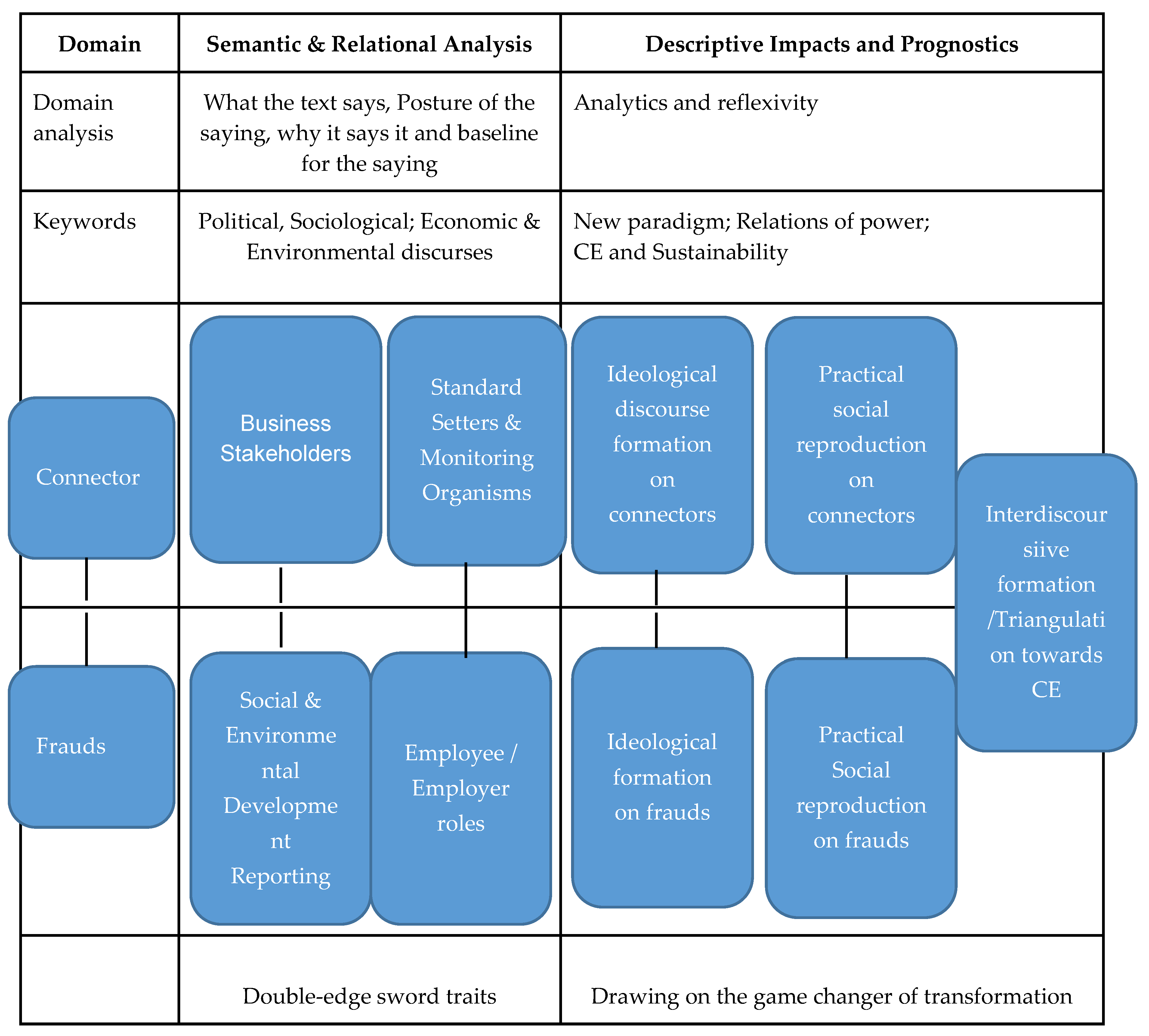

4. Investment Impacts of Pillar One and Pillar Two

PDF) Does Lowering Dividend Tax Rates Increase Dividends

4. Investment Impacts of Pillar One and Pillar Two

PDF) Foreign Direct Investment with Tax Holidays and Policy

PDF) Net profit flow per country from 1980 to 2009: The long-term

5 Foreign Direct Investment in China: Some Lessons for Other

Determinants of profit repatriation: Evidence from the Czech

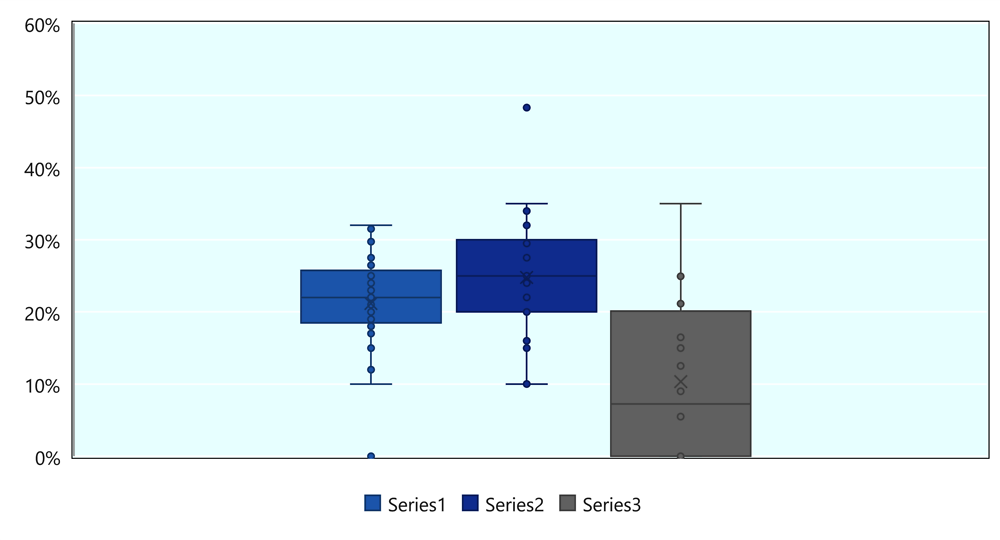

Correlation Matrix: Governance Infrastructure and Other Measures N

Tax holidays and profit-repatriation rates for FDI firms: the case