Enterprise Risk Management and Performance Improvement: A Study with Brazilian Nonfinancial Firms

Por um escritor misterioso

Descrição

Purpose – This research aimed to study the relationship between Enterprise Risk Management (ERM) and performance improvement.Design/methodology/approach – A questionnaire was used as an instrument of data collection that was passed to managers of nonfinancial companies listed among the 500 largest and best firms in Brazil. The data from this study were analyzed with descriptive statistics and multivariate analysis of correlation and association.Findings – The results showed that the main drivers of risk management were regulation, stakeholder demands, and business competitiveness. Among the practices that have been used, managers spotlight the utility of basic methods, more subjective, while technical methods, more quantitative, were of secondary importance. It was evidenced that the risks were weighted in the main activities of the organization. As a result, it was demonstrated that improved performance is associated with the maturity level of risk management and the level of stakeholders’ involvement in risk management.Research limitations/implications – Other researches could examine how this process was developed in other countries and expand the number of organizations studied.Practical implications – This study provides empirical evidence about theorist assumptions about the relationship between ERM and performance improvement.Social implications – This study demonstrates the importance of human aspects for the processes of risk management and how external factors can influence this process.Originality/value – It gives a broader and deeper comprehension of the process of risk management at nonfinancial firms in Brazil.

JRFM, Free Full-Text

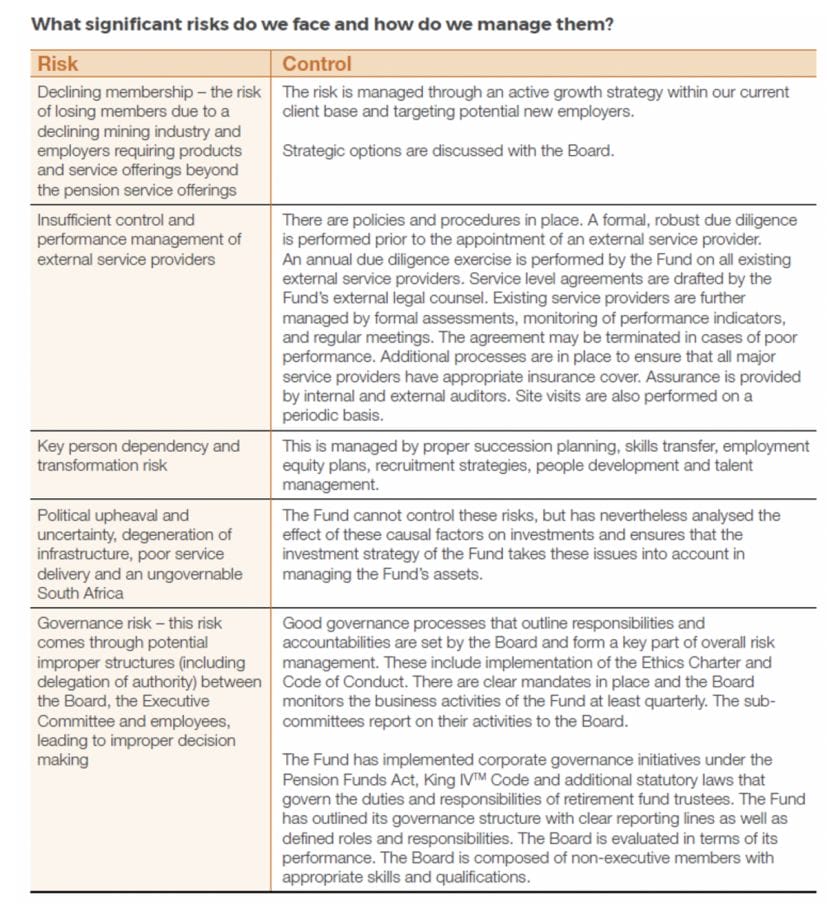

Funds need to evolve governance disclosures

Managing non-financial risks (NFRs) has never been more critical to a firm’s success. Since the global financial crisis, markets have not only seen an

Non-Financial Risk Management: Emerging stronger after COVID-19

PDF) Enterprise Risk Management and Corporate Performance in Nigerian Non-Financial Quoted Companies

PDF) The influence of enterprise risk management on firm performance with the moderating effect of intellectual capital dimensions

JRFM, Free Full-Text

12 Reasons Risk Management Fails

Financial institutions and nonfinancial risk: How corporates build resilience

Flexibility and Resilience in Corporate Decision Making: A New Sustainability-Based Risk Management System in Uncertain Times

Risk Management Software from Enablon

PDF) The effect of Enterprise Risk Management on the risk and the performance of Spanish listed companies

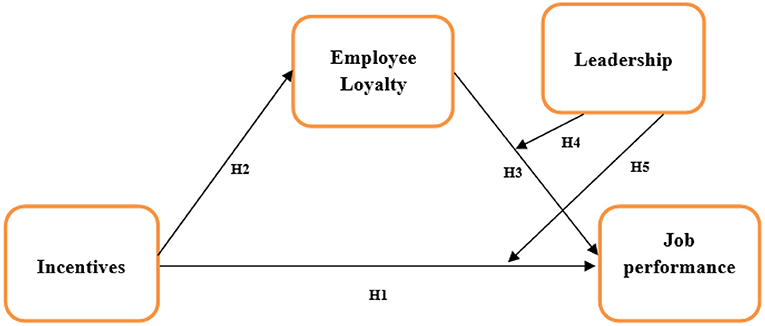

Frontiers The Impact of Incentives on Job Performance, Business Cycle, and Population Health in Emerging Economies