Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Descrição

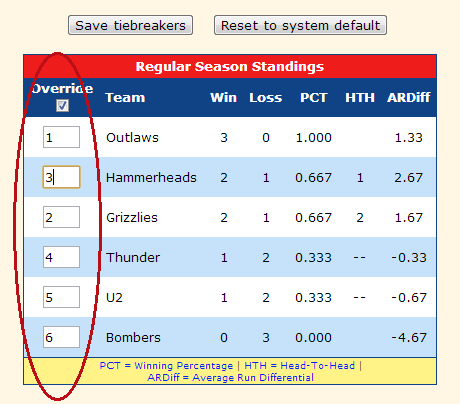

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

Closer Connection Test or a Treaty Tie-Breaker Provision

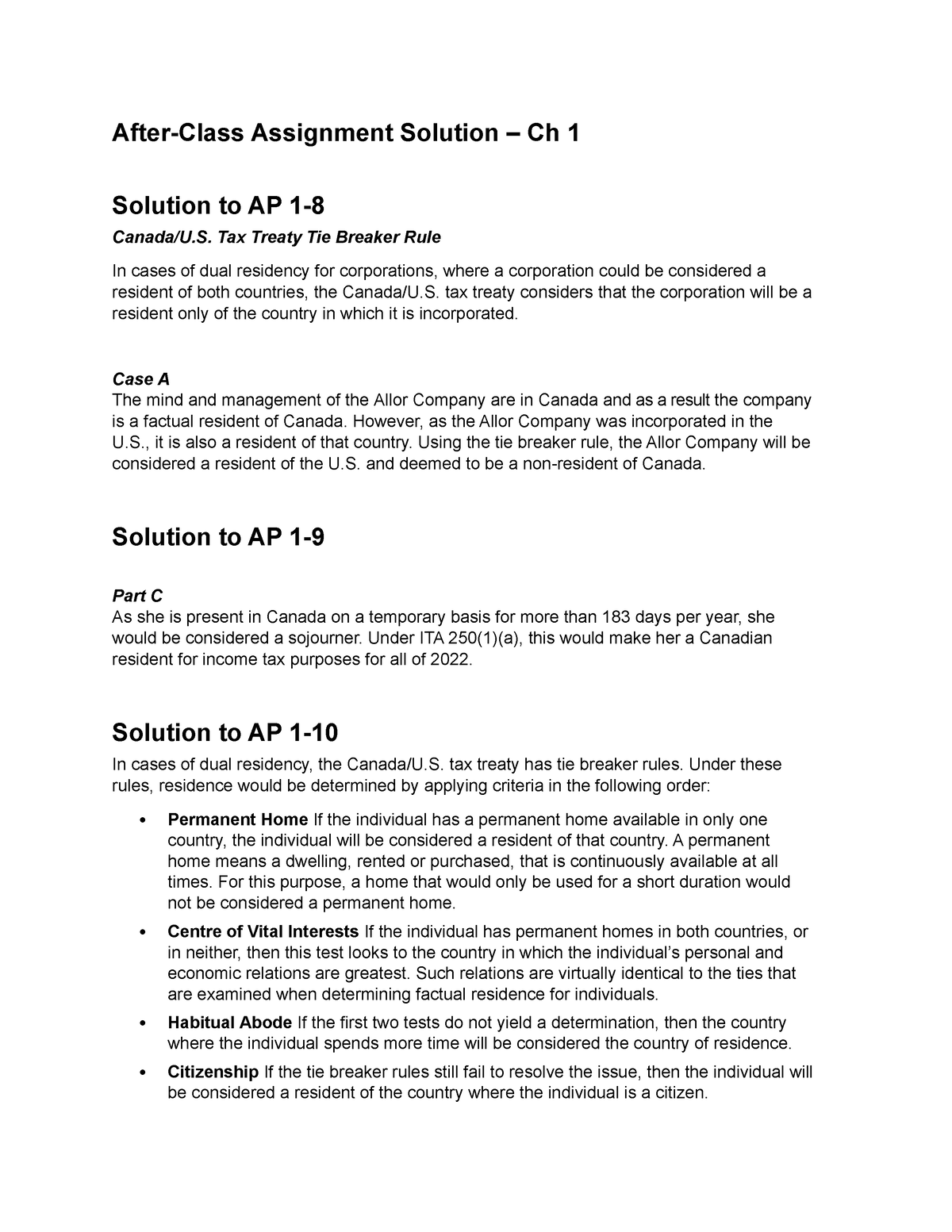

Week 2 Ch1 Assignment Solution - After-Class Assignment Solution – Ch 1 Solution to AP 1- Canada/U. - Studocu

Tax Treaties Business Tax Canada

Article 4(2) - Tie breaker Rule in case of an individual - +91-9667714335

Keyword:individuals tax residency - FasterCapital

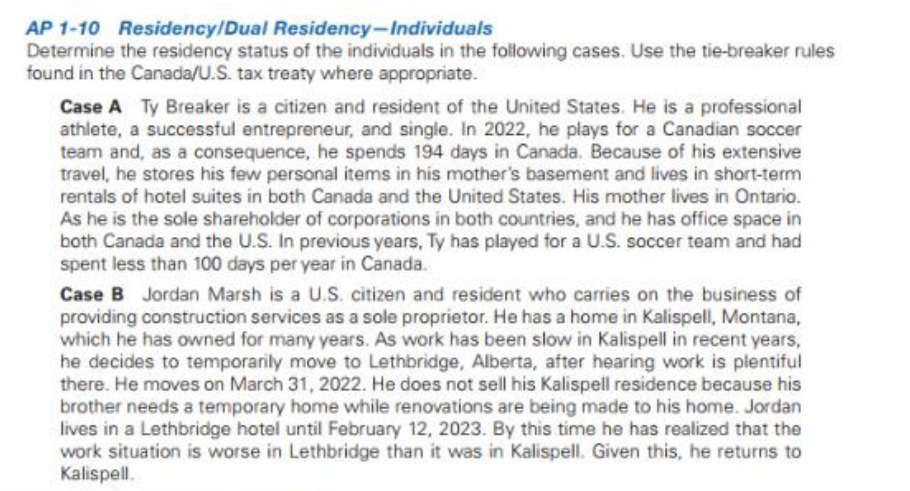

Solved P1-10 Residency/Dual Residency-Individuals etermine

Navigating Tax Treaties: Insights from IRS Publication 519 - FasterCapital

International Taxation

Cross Border Transactions and Tax Treaties - PDF Free Download

Tax Treaties and Green Card Holders - Expat Tax Professionals

Relief Under Section 90/90a/91 of Income Tax Act, DTAA

How To Handle Dual Residents: IRS Tiebreakers