Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Descrição

Publication 970 - Introductory Material Future Developments What's New Reminders

Other Tax Forms and Taxable Income

How College 529 Savings Account Withdrawals Are Taxed & Why You May NOT Want to Use a 529 Plan Altogether - Lifetime Paradigm

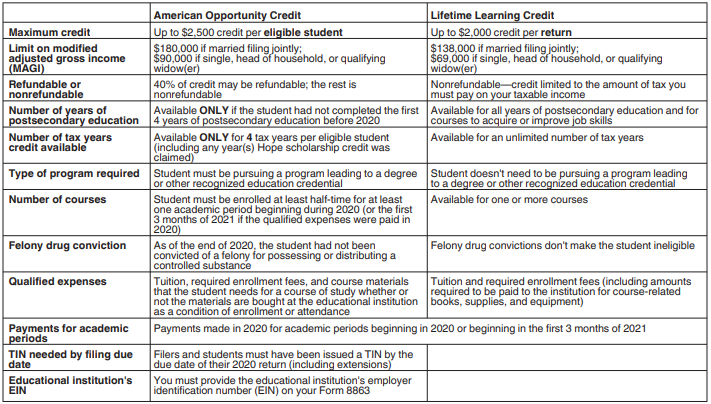

1040 - American Opportunity and Lifetime Learning Credits (1098T)

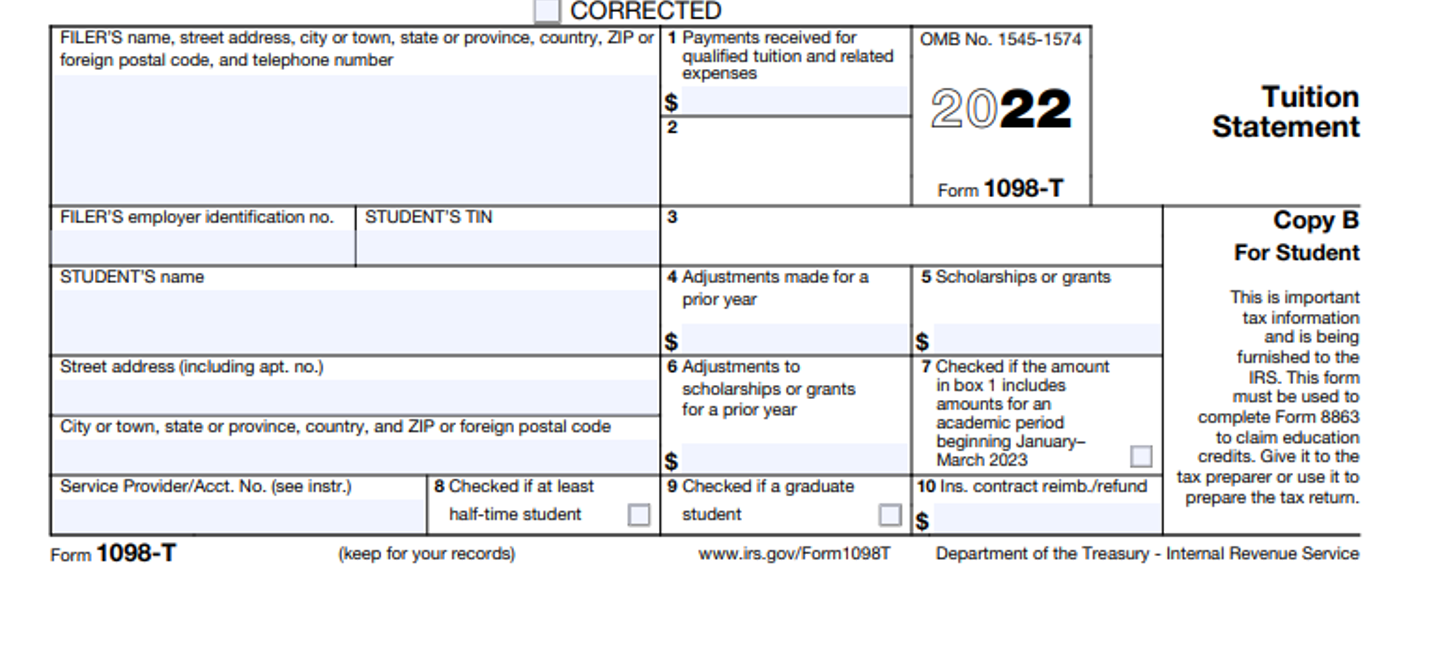

Form 8863 - Education Credits (American Opportunity and Lifetime Learning Credits)

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

:max_bytes(150000):strip_icc()/taxsmart-ways-help-your-kidsgrandkids-pay-college.aspv2-ca33db2b45af47d2bcd23ca1a70304df.jpg)

Tax-Smart Ways to Help Your Kids or Grandkids Pay for College

Publication 970 (2022), Tax Benefits for Education

IRS Form 8863 Instructions

Teachers' out-of-pocket classroom costs worth $300 tax break - Don't Mess With Taxes

Tax Credits for Education Waubonsee Community College

IRS Form 1098-T, Enrollment Services (RaiderConnect)

IRS CP 79- We Denied One or More Credits Claimed on Your Tax Return

Publication 970 (2022), Tax Benefits for Education

Educator expense tax deduction increases for 2022 returns

Education Tax Credits – Get It Back