Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Descrição

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

Brexit VAT changes: The impact on UK SMEs — Just Entrepreneurs

How to handle value-added tax (VAT)

Guide To Planning Your VAT Return by Tax Librarian - Issuu

The UK Value Added Tax Rate (VAT) Explained – CruseBurke

UK VAT (Value Added Tax) Guide - Updated for Post Brexit Impact

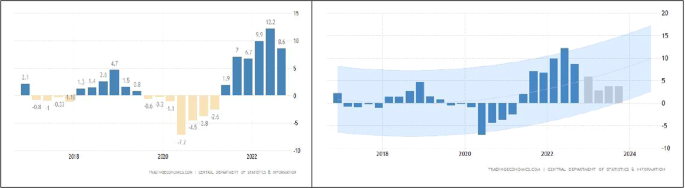

Value-added-tax rate increases: A comparative study using difference-in-difference with an ARIMA modeling approach

How Do Countries Tax Corporations?

Value-Added Tax (VAT): Definition, Who Pays - NerdWallet

The rise of high-tax Britain - New Statesman