2017 Tax Law Is Fundamentally Flawed

Por um escritor misterioso

Descrição

The major tax legislation enacted in December 2017 will cost about $1.9 trillion over ten years and deliver windfall gains to wealthy households and profitable corporations, further widening the gap

TPC: Impacts of 2017 Tax Law's SALT Cap and Its Repeal

Addressing Tax System Failings That Favor Billionaires and

IRS Apologizes For Aggressive Scrutiny Of Conservative Groups

:max_bytes(150000):strip_icc()/GettyImages-taxes-man-on-floor-56ce24173df78cfb37a3a2d3.jpg)

What's Wrong With the American Tax System

Does Lowering the Corporate Tax Rate Spur Economic Growth?

Why It's So Hard to Simplify the Tax Code

Supreme Court Will Hear Case That Could Upend The Current Tax System

End the Tax Exclusion for Employer-Sponsored Health Insurance

Bishops: Congress can still address “fundamental flaws” in tax law

How did the Tax Cuts and Jobs Act change personal taxes?

Uber shifted scrutiny to drivers as it dodged tens of millions in

2024 State Business Tax Climate Index

Taxing the rich: The effect of tax reform and the COVID-19

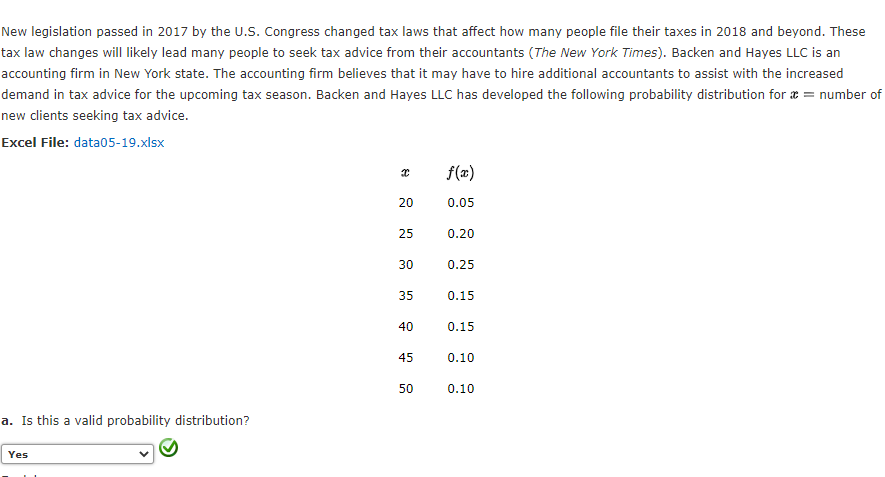

Answered: New legislation passed in 2017 by the…